Investment and portfolio management involves selecting and overseeing assets that meet an investor’s long-term financial objectives and risk tolerance. However, investing is not only about numbers and strategies but also about understanding the effect of external factors on the performance of the markets and the assets.

El Nino’s effect in India can be seen in food production, water resources, and overall well-being. El Niño can also affect inflation, interest and exchange rates, stock prices in India, and global commodity prices and trade flows.

Therefore, understanding the El Niño cycle is crucial for investment and portfolio management to anticipate and mitigate the risks and opportunities that arise from this natural phenomenon.

In this article, we will explain how the El Niño cycle works, study the El Nino effects in India, and suggest ways to build a resilient portfolio.

What is the El Nino cycle, and how does it work?

The El Nino cycle, which is anticipated to occur in 2024, will significantly impact your portfolio returns and financial stability. It’s a natural occurrence in the Pacific Ocean that has an impact on weather patterns all over the world.

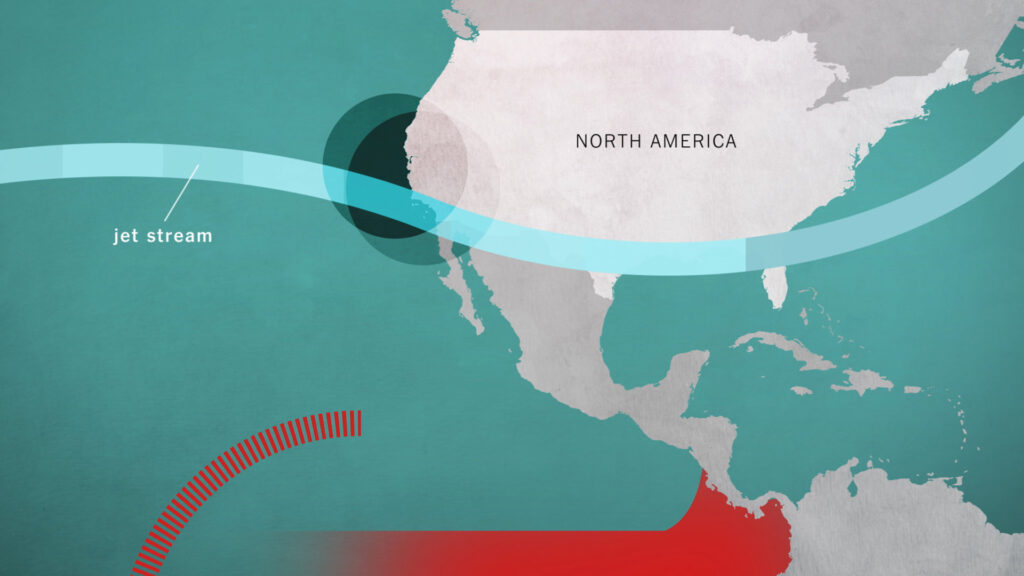

El Nino is identified by warmer ocean temperatures near South America, which weaken east winds and modify rainfall patterns over the tropics. La Nina occurs when the ocean waters are cool, and the winds are strong.

El Nino and La Nina form the El Nino Southern Oscillation (ENSO) cycle, which occurs every two to seven years and lasts nine to two months. Since 1901, India has witnessed 22 El Nino events, out of which 16 resulted in drought or drought-like conditions.

El Nino’s effects in India are primarily on the monsoon, which affects agriculture and agriculture-related industries in one of the world’s largest and fastest-growing economies. In India, El Nino is frequently connected with decreased rainfall, droughts, and lower crop yields, particularly in the northern regions where irrigation primarily relies on rainwater.

El Nino Effects in India: Challenges

El Nino effects in India are both challenging and rewarding, depending on its intensity, timing, duration, and climatic variations.

Some of the challenges that El Nino effects in India can create are:

- Reduced rainfall, droughts, and lower crop yields

El Nino is often marked by scanty rains, droughts or drought-like conditions, and lower crop yields in India, especially in northern India. El Nino effects in India also include poor crop quality due to disproportionate rains, pest infestation, and disease outbreaks, which can further reduce agricultural output and income.

- Rising Inflation and Market Volatility

El Nino effects in India include inflation, interest rates, exchange rates, and stock prices in India, as well as the global commodity prices and trade flows. El Nino can cause higher food prices, lower rural demand, and lower export earnings, increasing inflation and, consequently, the stock market volatility in India.

- Health, education, and social welfare

El Nino effects in India include the health, education, and social welfare of the people. El Nino can increase the risk of malnutrition, dehydration, heat stress, and infectious diseases, affecting physical and mental health.

El Nino Effects in India: Opportunities

- Innovation, adaptation, and resilience

El Nino can also foster prospects for Indian innovation, adaptation, and resilience. Taking lessons from past situations can help people, corporations, and governments prepare for future scenarios.

However, one of the El Nio effects in India is a drop in agricultural GDP, high temperatures, and heat waves, which bring up new chances for AC, fridges, and other consumer items in India.

- Growth, development, and transformation

El Nino effects in India can also create growth, development, and transformation opportunities. It can accelerate India’s transition from an agricultural to an industrial and service-based economy, increasing the income, employment, and consumption of the people in India.

- Globalization

El Nino can also enable the globalization and regionalization of the Indian economy, enhancing international trade, global investment, and India’s cooperation with the rest of the world.

El Nino’s effects in India can catalyze change and development, transforming society, investor psychology, and the economy in the long run.

The Bottom Line

When the world’s leading economies, investment, and portfolio management companies are concerned about how the El Nino cycle may affect their life, your concern is understandable. In the article, we addressed the challenges and opportunities that the El Nino cycle that is about to hit the planet may bring to India.

Portfolio diversification using different financial instruments such as Bonds, Derivatives, Futures, and Options and then rebalancing your portfolio according to the evolving economic scenarios are strategies leading investment and portfolio management companies employ to counter the El Nino effects in India.

Conduct careful research and invest wisely to establish a resilient portfolio for the El Nino event.